All print service providers (PSPs) are not created equal, and today’s market shows a clear delineation of the leaders and the laggards. Whereas leading PSPs are thriving and enjoying double-digit growth in revenue and profits, the laggards are often struggling to keep their doors open. As technological advancements continue and the capabilities of competitive providers become begin to blur, customers are finding it increasingly difficult to distinguish one press from another, or even one PSP from another. Consequently, price is often the deciding factor and the services within the industry are frequently viewed as commodities.

Recent research from Keypoint Intelligence – InfoTrends (InfoTrends) confirms that thriving PSPs behave in markedly different ways than their struggling counterparts do. One clear distinction is that leading PSPs place a much stronger emphasis on value-added services. According to InfoTrends’ study entitled Winning in an Evolving Print Services Market, organizations that are not focusing on value-added services are finding it difficult to grow their revenues and align their value to their clients’ business needs. Although changing your approach might make you feel like a fish out of water, thriving PSPs have figured out that value-added services represent a huge area of opportunity for success. This analysis, the first in a three-part series on best practices of leading PSPs, discusses the importance of highlighting the benefits that customers and prospects can enjoy from value-added services. To keep their offerings fresh and current, today’s PSPs must change the conversation and shift the focus away from price and toward value-added services.

Key Findings

- High-growth PSPs are enjoying higher profit margins on all types of value-added services.

- The most popular print-related value-added services are more traditional ones like bindery, finishing, mailing, and personalization.

- Digital media services are not as widespread as print-related value-added services, but the most commonly offered ones include mobile 2D barcode generation/tracking (e.g., QR codes, MS tags) and website development.

- PSPs across all categories recognize that future growth will stem from a stronger reliance on digital color printing, wide format printing, and non-print-related value-added services.

Recommendations

- Carefully assess your clients’ current needs against your offerings. Think specifically about the print- and non-print-related value-added services that you are not currently offering. If these services could benefit existing customers or help attract new ones, adjust your portfolio accordingly.

- When seeking opportunities for future growth, consider products and services that are adjacent to your existing ones. By expanding your value-added services into adjacent areas, you can increase revenues among existing customers while also attracting new prospects to your business.

- Although print-related value-added services are quite common among PSPs, many may not think to offer non-print-related value-added services like marketing services, data services, and graphic design.

These non-print-related value-added services are key to future growth because they enable PSPs to differentiate themselves while also becoming more of a one-stop shop.

Survey Background

In total, 226 print-for-pay and in-plant PSPs participated in InfoTrends’ Winning in an Evolving Print Services Market research. To better illuminate how these firms are faring in relation to their peers and isolate the best practices of high-growth companies, the PSPs were divided as follows:

- Declining (N=34): PSPs that reported any revenue decline between 2016 and 2017

- Flat (N=55): PSPs whose revenues remained unchanged between 2016 and 2017

- Moderate Growth (N=99): PSPs that experienced a revenue growth of less than 10% between 2016 and 2017

- High Growth (N=38): PSPs that achieved double-digit revenue growth (10%+) between 2016 and 2017

The Value-Add Advantage

In effort to achieve desired profit levels and ongoing revenue growth, PSPs have historically focused on identifying the most efficient way to print their customers’ jobs. Although this is certainly a very sound practice, some of our industry’s leaders are finding that shifting their focus to value-added services is another great strategy for growth.

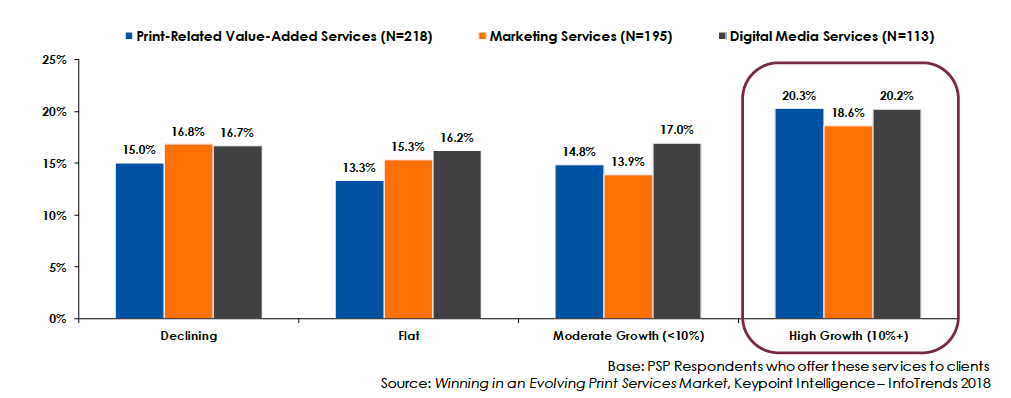

Reframing your product portfolio by shifting the focus to the value that it delivers can bring you freedom from price wars. Instead of seeking opportunities to reduce fixed costs or price-matching your competitors to maintain margins, you can attract new customers and retain existing ones by setting a new standard and consistently delivering added value. InfoTrends’ research confirms that in relation to their peers, high-growth PSPs consistently achieved a higher profit margin for the services that they offered.

Figure 1: High-Growth PSPs Achieve Higher Profit Margins

Delivering Value-Add to Clients: The Basics

Delivering Value-Add to Clients: The Basics

Print-Related vs. Non-Print-Related Value-Add

Within the printing industry, value-added services can be broadly classified into two categories: print-related value-added services and non-print-related value-added services. Whereas non-print-related services are ancillary to print but not directly related (e.g., finishing, design, photography), print-related value-added services are often vital to the delivery of a print order.

The question is this—if almost every print environment offers these print-related services, how can they be considered an added value for the customer? Ultimately, the value comes in the form of a lasting impression. For example, think about the last time someone handed you a business card that really got your attention. What was it that caught your eye? Did the card have rounded corners, a unique coating, or gold/silver embellishments? These details stand out because people commit them to memory.

The Table below outlines the share of PSPs who currently offer various types of print-related value-added services. Offerings like bindery, personalization, mailing, and fulfilment are quite common among all types of PSPs and can therefore be considered “table stakes” for competing in the industry. Meanwhile, high-growth PSPs are setting themselves apart by placing a greater focus on web-to-print, CMYK+, print management, and wide format display installation services.

Table 1: Print-Related Value-Added Services

Although print-related value-added services are quite common among PSPs, many may not think to offer non-print-related value-added services like marketing services, data services, and graphic design. These non-print-related value-added services are key to future growth because they enable PSPs to differentiate themselves while also becoming more of a one-stop shop.

Although print-related value-added services are quite common among PSPs, many may not think to offer non-print-related value-added services like marketing services, data services, and graphic design. These non-print-related value-added services are key to future growth because they enable PSPs to differentiate themselves while also becoming more of a one-stop shop.

Challenges Associated with Delivering Value-Added Services

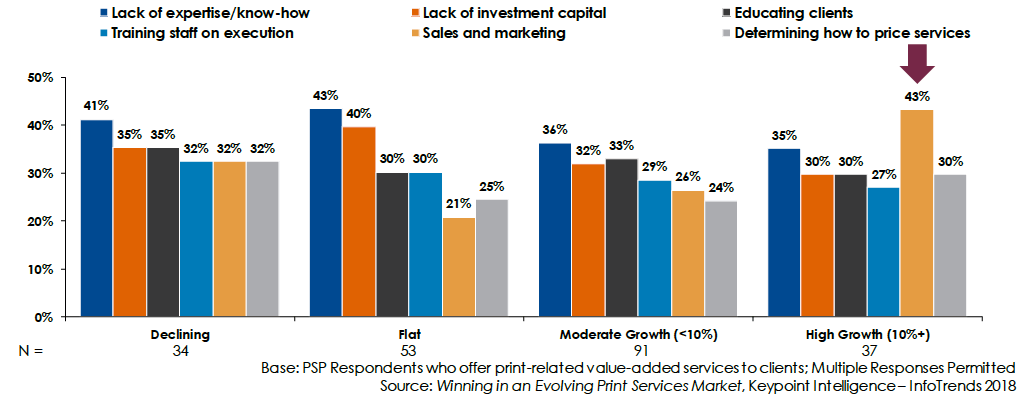

Of the 226 total PSPs that participated in InfoTrends’ research, the vast majority—over 95%—are offering print-related value-added services. Although PSPs clearly understand the importance of these services, they did acknowledge encountering some challenges when offering them.

As shown in the Figure below, sales and marketing was the top challenge for high-growth print operations. Meanwhile, declining and flat PSPs were considerably more likely to cite lack of expertise and lack of investment capital as the top challenges associated with adding value-added services to print operations. The key message is that although high-growth PSPs may struggle with the development of sales and marketing messages, they have developed the expertise and collateral to create value in the form of a lasting impression.

Figure 2: Challenges Associated with Delivering Value-Added Services

Although offering value-added services is not without challenges, it is always a good idea to assess your clients’ current needs against your offerings. Think specifically about the print- and non-print-related value-added services that you are not offering at this time. Could the addition of these services benefit your existing customers or help attract new ones? If the answer is yes, adjusting your portfolio accordingly can have an immediate impact on your bottom line.

Although offering value-added services is not without challenges, it is always a good idea to assess your clients’ current needs against your offerings. Think specifically about the print- and non-print-related value-added services that you are not offering at this time. Could the addition of these services benefit your existing customers or help attract new ones? If the answer is yes, adjusting your portfolio accordingly can have an immediate impact on your bottom line.

Digital Media Services

In relation to print-related value-added services, PSPs are generally less likely to be offering digital media services like QR codes, website development, social media services, or mobile app development. Only half of the PSPs that participated in our research were offering any type of digital media services. Among those respondents who were offering these services, the most common types included mobile 2D barcode generation/tracking and website development/hosting. Although most digital media services were not particularly common among any respondents, high-growth PSPs were more likely to offer digital publishing, social media, mobile application development, and digital signage services.

Figure 3: Digital Media Services Offered

Seeking opportunities for future growth can seem daunting, particularly in lesser-known areas like digital media services. To make the process less overwhelming, start small by considering products and services that are adjacent to your existing ones. Expanding your offerings into adjacent areas can bring in additional revenues from existing customers while also attracting brand new prospects to your business.

Seeking opportunities for future growth can seem daunting, particularly in lesser-known areas like digital media services. To make the process less overwhelming, start small by considering products and services that are adjacent to your existing ones. Expanding your offerings into adjacent areas can bring in additional revenues from existing customers while also attracting brand new prospects to your business.

What Does the Future Hold?

To gain a greater understanding about expectations for future growth, PSPs were asked about the types of services that drove their revenues today and how they expected this to change over the next two years. Regardless of revenue performance, PSPs across all categories recognize that future growth will stem from a stronger reliance on digital color printing, wide format printing, and non-print-related value-added services.

Figure 4: Revenue from Services – Current vs. Future

InfoTrends’ Opinion

InfoTrends’ Opinion

Focusing on value-added services may be more important now than it has ever been before. Organizations that ignore this best practice may find it increasingly difficult to grow their revenues and align their value to their clients’ business needs. Although course-correcting and taking a new approach may seem daunting, many of today’s top-performing PSPs have discovered that value-added services can be a primary driver for growth. All PSPs are working to keep their offerings fresh and current, and value-added services represent a great way to change the conversation and shift the focus away from price